Helpful Hints and Payment Set-up FAQs:

Helpful information and guidance on the most frequently asked questions regarding setting up a payment account

Helpful Hints & FAQ:

- Every time I log into Stripe, it requires a 2-step authentication. Why?

Stripe requires two-step authentication to keep your account and payment information secure. This extra layer of protection helps prevent unauthorized access, supports compliance with financial regulations, and protects sensitive data like your bank and tax details.

It’s a standard security measure used by most financial platforms to ensure your information stays safe.

- I keep seeing "Welcome Back" instead of "Let's Get Started"; why?

Stripe's “account links” are single-use URLs, but Stripe also drops a cookie on thestripe.comdomain to remember that you’ve already launched onboarding (aka clicked the create account button). As soon as you hit that URL a second time in the same browser session, even if you refresh, Stripe will present the Welcome back! screen, not the very first Let’s get started splash. If you start the process but do not complete it, please reach out to us at info@tourneydirect.com so that we can send you a new single-use URL. - Why am I seeing an error message in Stripe after entering my EIN or SSN?

Stripe verifies your tax ID against IRS records, so the legal name or business name you enter must match exactly what’s on your IRS-issued documentation (including spelling, hyphens, accents, commas, and spaces). Any discrepancy will trigger a verification error. This is a government regulation that all payment processors must adhere to. In addition to providing the correct tax identification number, the spelling and formatting of the Legal business name that you provide must exactly match your official IRS-issued documentation. Any minor difference in the business name – including spaces, hyphens, accents, apostrophes, etc – will result in an error.

If you use a SSN

- Refer to your social security card to see how your name is formatted.

- If you don’t have your social security card, or if you believe you’ve entered the correct information but still receive an error, contact the Social Security Administration to request a copy of your social security card or update your name here: https://www.ssa.gov/ssnumber/

If you use an EIN

- Refer to an IRS-issued official document with your business name, such as an SS-4 confirmation letter or Letter 147C, you can see how the IRS has recorded your business name. Refer to this guide to learn how to interpret these documents.

- If you don’t have an IRS-issued document, or if you believe you’ve entered the correct information but still receive an error, contact the IRS Business & Specialty Tax Line at 800-829-4933.

- Please note that when you enter your tax ID number (TIN/EIN), it is checked against the IRS's database. If the IRS database doesn't provide confirmation that the legal name matches the TIN/EIN, an error message saying your TIN/EIN number can't be verified. The spelling and formatting of the legal business name must exactly match your official IRS-issued documentation. Any minor difference in the business name (including spaces, hyphens, apostrophes, etc.) will result in an error.

Why did you move from checks onsite to electronic payouts?

Electronic payouts provide enhanced benefits to coaches that physical checks do not:

- You need flexibility and require last minute changes (i.e. you need to send a different coach last minute; you can only stay for one day not two changing the stipend amount, a stipend spot opens-up last minute, etc.)

- You want a seamless payout that removes the risk of losing a check or forgetting to pick up a check at the end of an event

- You accept new jobs seasonally resulting in frequent moves impacting end-of-year 1099 distributions

- You want a safe, seamless, and easy way to track your stipend payments per confirmed stipend events

- You work many, many events throughout the year; with Tourney Direct, you sign-up once and can receive payment from multiple events

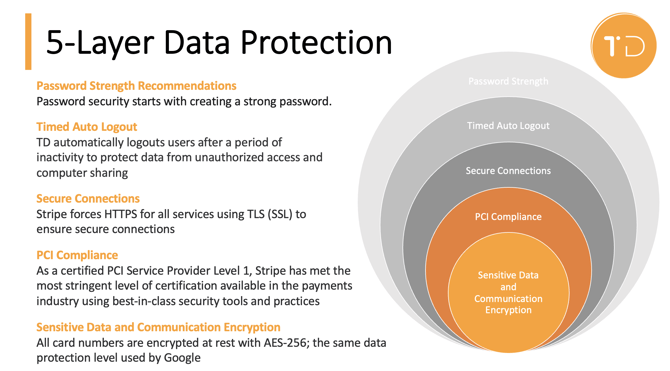

Is my information safe?

TD Pay powered by Stripe provides you with 5-layers of data protection.